39

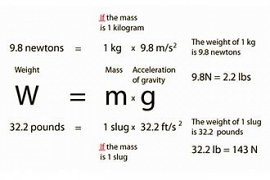

Newton

Scale the Newton scale to measure temperature was by Isaac Newton around the year 1700 AD was proposed. This scale initially, the temperature to 12 parts, that of the cold of winter to the heat of the coals, combed fire on the cover. It is scalable to the size of the raw and flawed, which was later Newton, it changed him a pot of linseed oil to prepare ... and changes its volume in proportion to the heat measured in the he realized that the volume change of the oil between the temperature of the snow, the water, the temperature of the boiling water, 7. the of 25%.

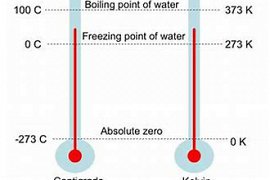

After that zero heat as the temperature of melting snow and 33 degrees as the boiling temperature of water defined. The scale of Newton, ahead of the annual be and Celsius when it was designed from the scale of Newton was aware of. Newton tool, your \"thermometer\" called.

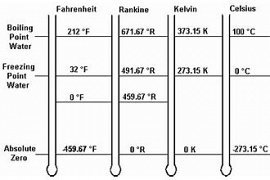

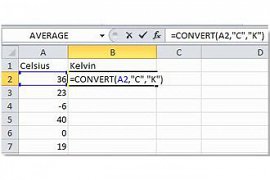

Newton is equal to 100/33 (almost 3٫03) Kelvin or degrees Celsius and zero in common with the scale of Celsius.

...

After that zero heat as the temperature of melting snow and 33 degrees as the boiling temperature of water defined. The scale of Newton, ahead of the annual be and Celsius when it was designed from the scale of Newton was aware of. Newton tool, your \"thermometer\" called.

Newton is equal to 100/33 (almost 3٫03) Kelvin or degrees Celsius and zero in common with the scale of Celsius.

...